First suite deed tax service process for High - Level Talents

The following services and processes are subject to the latest policy, with the latest policy

date:2016-12-12

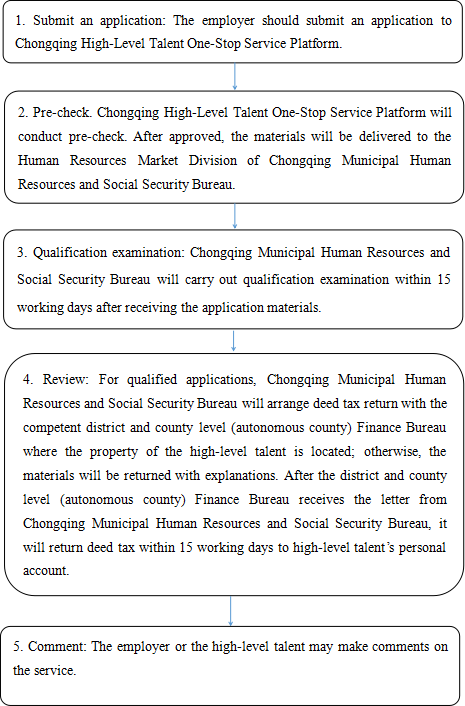

(1) Submit an application: The employer should submit an application to Chongqing High-Level Talent One-Stop Service Platform.

(2) Pre-check. Chongqing High-Level Talent One-Stop Service Platform will conduct pre-check. After approved, the materials will be delivered to the Human Resources Market Division of Chongqing Municipal Human Resources and Social Security Bureau.

(3) Qualification examination: Chongqing Municipal Human Resources and Social Security Bureau will carry out qualification examination within 15 working days after receiving the application materials.

(4) Review: For qualified applications, Chongqing Municipal Human Resources and Social Security Bureau will arrange deed tax return with the competent district and county level (autonomous county) Finance Bureau where the property of the high-level talent is located; otherwise, the materials will be returned with explanations. After the district and county level (autonomous county) Finance Bureau receives the letter from Chongqing Municipal Human Resources and Social Security Bureau, it will return deed tax within 15 working days to high-level talent’s personal account.

(5). Comment: The employer may make comments on the service.

Application materials: a written letter from the employer, a proof of housing registration information query, a proof of deed tax payment, legitimate bank account of relevant high-level talent.

Deed Tax Relief Service Process for First Property Purchase of High - Level Talents

责任编辑:管理员